1. Introduction to TMPV

The focus on TMPV Share Price begins with a major corporate event — the demerger of Tata Motors Ltd., which led to the passenger vehicles business now operating independently under the name Tata Motors Passenger Vehicles Ltd. (ticker: TMPV). This strategic restructuring has significant implications for investors, as it highlights Tata Motors’ effort to unlock value and create a focused automotive segment. As a result, market analysts are closely monitoring the TMPV share price to assess long-term growth potential and overall brand valuation.

Thank you for reading this post. Don't forget to subscribe!

2. What Is the TMPV Share Price Now?

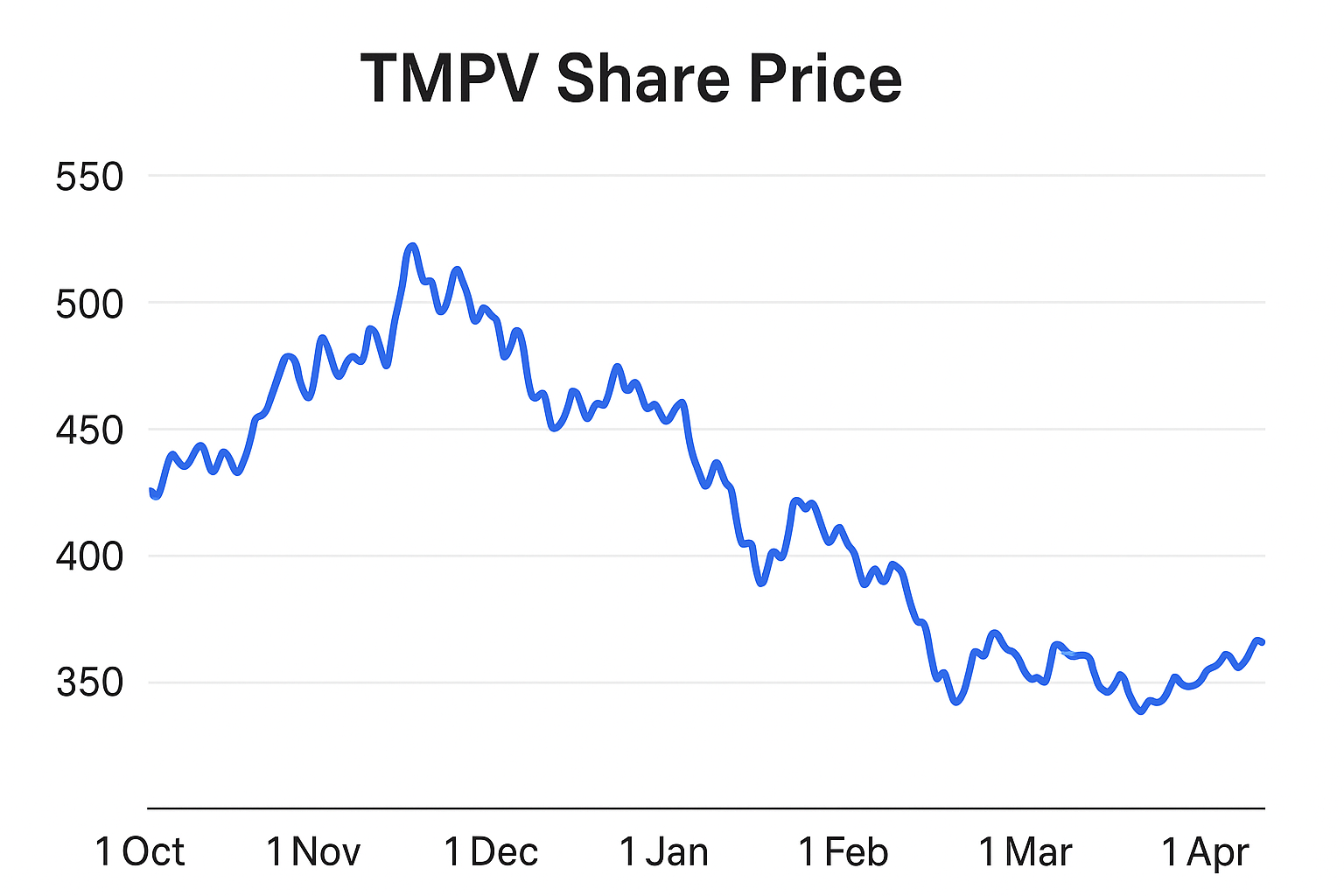

As of recent reports, the TMPV Price is hovering around ₹403.50 per share in India, reflecting steady investor confidence after the highly anticipated Tata Motors demerger. Over the past few months, the stock has shown resilience despite broader market fluctuations, suggesting that investors have long-term faith in the company’s passenger vehicle division. The 52-week price band for TMPV ranges between ₹335.30 and ₹549.96, indicating moderate yet healthy volatility in the post-demerger phase. Analysts believe the Share Price could gain upward momentum as the company continues to improve production efficiency, expand its EV lineup, and strengthen its domestic market share. Therefore, keeping a close watch on this stock remains crucial for serious investors.

3. Why Did TMPV’s Price Change?

The reason behind movement in the share price heavily links to the demerger of Tata Motors’ commercial vehicle business. On the record date, shareholders were allotted shares of the new entity Tata Motors Commercial Vehicles Ltd. (TMLCV).

Also, brokerages note that the performance of Jaguar Land Rover (which forms a large part of TMPV’s valuations) and global factors are influencing sentiment.

Thus, when you monitor TMPV share price, consider both corporate restructure triggers and global automotive trends.

4. Key Valuation Metrics of TMPV

Here are some important figures for TMPV share price that every investor should know before making a decision. The price-to-earnings (P/E) ratio stands at approximately 17.25×, indicating a moderate valuation post-demerger. The return on equity (ROE) is around 28.12%, reflecting strong profitability and efficient capital use. During the price discovery session, the TMPV share price was determined to be roughly ₹400 per share, which many analysts consider a fair starting point. Investors who are tracking the TMPV price closely should benchmark these key metrics against industry peers to assess whether the stock offers long-term growth potential and value stability.

5. Investor Considerations & Risks

Before investing, pay close attention to how the TMPV share price may be influenced by several critical factors. Global economic uncertainty and diffused demand across major automotive markets could impact profitability and stock momentum. Additionally, the recovery pace of Jaguar Land Rover (JLR) operations will play a vital role in determining future valuations of TMPV. Investors should also monitor the timing of the TMLCV listing, as value unlocking from the commercial vehicle division may take time. Overall, while the TMPV share price appears promising, the risk profile remains moderate to high.

6. Final Thoughts on TMPV Share Price

In summary, the TMPV Share Price reflects a freshly carved out, focused passenger vehicle business of Tata Motors. The ~₹400 per share level marks a key baseline. But for long-term investors, watching post-demerger progress, global automotive cycles, and structural growth will drive the next leg of value. If you’re considering the TMPV share price for your portfolio, align it with your risk tolerance and timeframe. For official updates, product information, and corporate announcements about the TMPV Share Price, visit the Tata Motors Passenger Vehicles official website.

Check out our latest blog on Gold’s Roller-Coaster Ride in India

more about Business & Economy